Sometimes, the most effective way to address a challenge is to recognize that it does not require a solution. One such challenge arises from the interplay between your investment/performance system (IBOR) and your General Ledger (GL).

Suggestions to address the discrepancy between IBOR and GL will vary by office, but during the decades we’ve spent working alongside family offices, we’ve found that there are valid reasons for the differences between the systems.

As a result, dealing with this issue may be as straightforward as documenting the distinctions, explaining them, and ensuring that everyone remembers them, instead of wasting time repeatedly fighting the same fight, and trying to “fix” one system or the other to make them match. We’ll explain below.

First, let’s define our terms so that we are all on the same page.

IBOR – Investment Book of Record

Typically used by the investment team reporting to the client their performance results, and for analyzing and aggregating client assets across a wide range of investments or holdings.

Examples include Advent APX, Addepar, and BlackDiamond.

GL– General Ledger

Typically, this system (the accounting book of records) is operated and maintained by the accounting team and it supports accounting and tax reporting needs and requirements. It generally focuses on tax id/individual account owners, rather than an account at a custodian.

Examples include QuickBooks, Sage Intacct, NetSuite, MS Dynamics, and JD Edwards.

NOTE: This article does not discuss systems that handle both IBOR and GL functions, like Advent Geneva, Eagle, or all-in-one systems focused on family offices like Archway or Eton.

Now, let’s look at three common differences between IBOR and GL systems:

- Timing:

Generally, accountants will close the books in the GL, but not in IBOR systems. By this, we mean that IBOR systems will go back and change numbers after the fact so that they accurately reflect performance. This occurs, for example, when investment reports from fund managers are delivered months after a reporting period concludes. GL systems, on the other hand, deal with current numbers, and once a number is posted in the system, it is “written in stone” and is not changed afterward because accounting reports are generally not restated.

- Gain/Losses:

There can be differences between realized and unrealized gains and losses since IBOR systems generally reconcile only open tax lots and market value, but not closed lots or realized gains. The GL usually ties back to the actual custodial realized gains and losses.

- Detail (or lack of):

IBOR systems will usually contain details regarding securities, while GL systems tend not to. The GL, on the other hand, tends to track more detail regarding checking and bank accounts, and other non-investment assets, than is required by an IBOR system.

Now, let’s focus on the two issues that we find are most common.

Timing:

It’s very common to receive statements for private equity accounts much later than is convenient. This may be annoying, but there is not much that any of us can do about it.

As we mentioned above, IBOR systems tend to go back in time and make changes shown on a new or updated statement, in order to ensure that the performance of the asset is shown accurately in the time period in which it occurred.

GL systems, on the other hand, focus on tax, accounting, and cash flow. The GL approach is that once the books are closed, they are closed, and something like an unrealized change in a market value in the past is not considered a reason to open up the book for a closed time period to make a change. If the change needs to be recorded, the difference will be included in the open period during which the new, updated, information was received.

In the above situation, both systems will show the same value as of “today,” but the history of each will be different, so they will not match. This mismatch can cause headaches and honest disagreements between the two systems and the groups that use them.

The quick summary: Most IBOR systems show the amount paid in the time period in which it was earned, to match the performance with the investment. GL will show the payment when the cash was received or accrued, rather than in the period it was earned.

Gain/Losses:

A frequently relied-upon, but incorrect, notion is that IBOR systems that reconcile tax lots will have the same realized gain/loss as the source that will be used to create the 1099 or K1. That is not always true. Most of the time that will be true, but most is not enough.

GL systems tend to “true-up” realized gains and losses to the custodial statements on a periodic or at least year-end basis.

This is not, however, as troubling as it may sound. Why? IBOR systems do not need to contain perfect realized gain/loss information in order to have accurate performance results. Why? When realized gain/loss is undervalued, your unrealized gain/loss will be overvalued by the same amount, meaning that it’s a wash and your total gain will be accurate, hence your performance results are still accurate.

As a result, in our experience, it is not worth the time, effort, or money to have your IBOR system reflect perfect realized gain/loss results. Be careful, though, because saying that the tax lots are reconciled is not the solution or the cure for this issue, instead, you need to reconcile your closed tax lots and your realized gain/loss to ensure accuracy.

We’ve learned to ask the following: When the tax forms are filled out for the end client, where does the realized gain (among other results) come from? Asking that question may shed light on the fact that the GL system may not be used for this information. Many times, the tax documents are created straight from the 1099/K1, and the information contained in GL, although useful for estimates, is not the actual source. Do not assume IBOR or even GL is the source of the information; we are shocked how many times that turns out not to be the case.

And we know that the best accountants only trust the source.

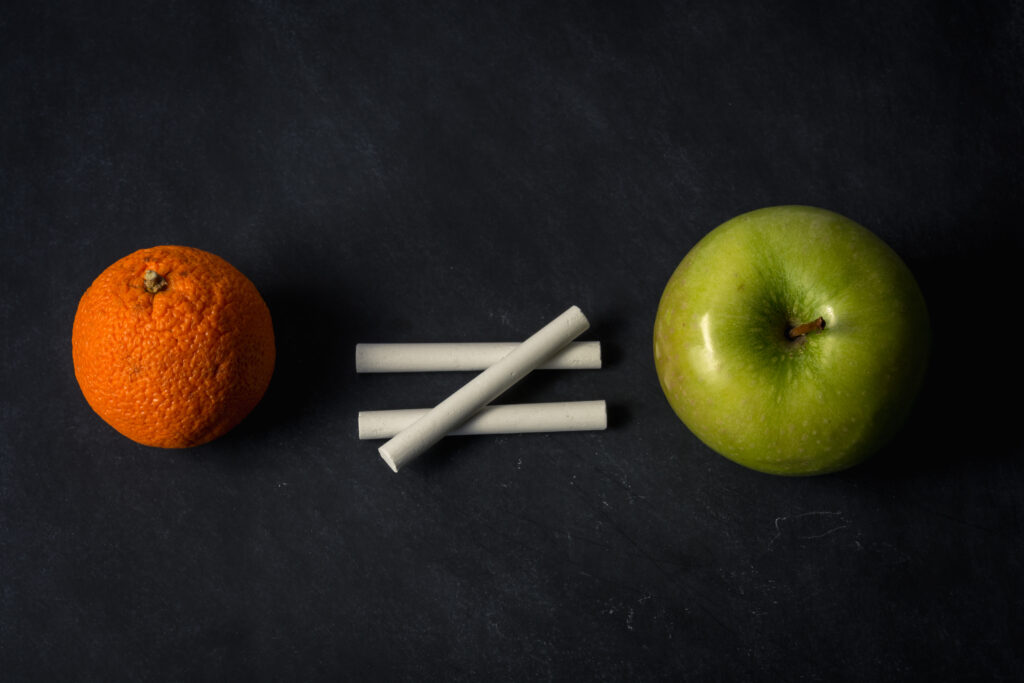

Stop Fighting the Same Fight

IBOR is for performance, GL is for accounting and tax. The IBOR system captures the valuation changes on their effective dates; when it is earned (performance), rather than received. The GL captures those valuation changes when received, not when earned. This causes timing differences between the two systems.

One advantage of having a separate IBOR and GL is that both teams/systems can process their data to suit their own needs.

“We have a lot of experience working with family offices, and while the optics of having the data in core internal systems tie out perfectly is appealing, the reality is that the data housed in these programs is meant for different purposes – so rather than constantly trying to reconcile any discrepancies, the preferred route is often to find best-in-class solutions to support the GL and IBOR discretely and run them in parallel.”

Ben Collins – Senior Director of Financial Services Marketing

Sage Intacct

So, we encourage you to stop arguing about which side is right – both sides are right.

It’s more effective to establish the rules for your office, and follow those rules. You need an agreement in your firm about the procedures that you will be using. Maybe, for example, your rule is that the accounting system closes 20 days after month-end, and that the investment and performance reporting side never closes (until maybe August of the following year). Ultimately, both systems will report the same market values, but will do so on different dates.

For those who want both systems to be in sync, the accounting system can be restated to mirror their investment system. Many offices do not restate their accounting systems.

“Family offices and other organizations that maintain considerable private equity or alternative holdings, however, frequently adjust their year-end books with K-1 adjustments to better align with their tax reporting. These documents can be received in Q2 and sometimes Q3 into the subsequent year. “

Bill Rouse – COO

KnowLedger, LLC

The Bottom Line

Your team does not have to keep fighting the same old fight. Instead, you can understand and accept that both sides can be different – and right.