Integrating investment data into a general ledger tailored for non-profit organizations presents several operational challenges. Non-profits often operate under strict regulatory frameworks and accounting standards, such as Generally Accepted Accounting Principles (GAAP) or the Financial Accounting Standards Board (FASB) guidelines. Ensuring compliance with these standards while accurately recording investment transactions can be complex. Investments may involve various financial instruments like stocks, bonds, and mutual funds, each with its own accounting treatment and reporting requirements.

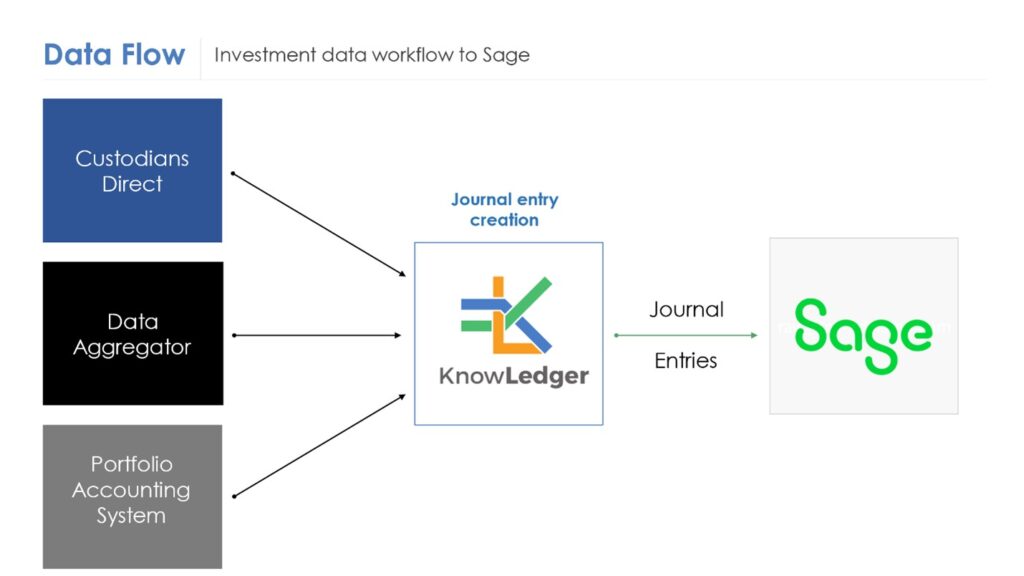

Consolidating data from various sources, including investment managers and financial institutions, becomes complex due to different formats. The challenge lies in standardizing and reconciling this information with the general ledger. Non-profits, often constrained by limited resources, may struggle with smaller finance teams. Implementing sophisticated systems may become difficult, and budget constraints could hinder investments in training or external consultants.

For non-profits, transparency in reporting investment activities is essential for financial stewardship and donor compliance.

KnowLedger was able to help the Kavli Foundation do just this, by integrating Addepar and Sage and easing the burden on their staff. Now their staff uses their accounting skills to review the data verse enter the data. Shelly Bushey, Senior Accounting Manager with the Kavli’s Senior Accounting Manager, Shelly Bushey says it very well:

“Our reconciliation process is now faster, more efficient, allowing for seamless integration and accurate reconciliation of investment data. “